Crypto OTC Trading Desk

Crypto OTC Trading Desk

We facilitate the trade of large amounts of crypto securely and efficiently. Whether you’re an institution, fund, or high-net-worth individual, our OTC desk ensures smooth transactions without affecting market prices. We provide deep liquidity, competitive pricing, and a secure, regulated trading environment.

We Offer

Taker-to-Maker Fee Optimization

Our proprietary algorithms intelligently route trades to capture maker rebates instead of incurring taker fees, significantly lowering execution costs. This means more efficient capital usage and reduced friction in every transaction.

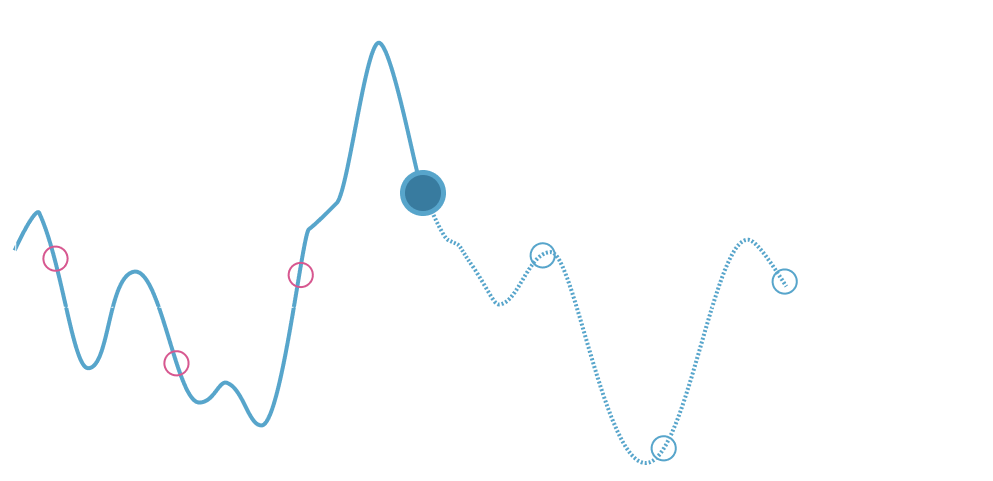

Slippage Minimization

Slippage refers to the difference between the expected price of a trade and the actual price at which it is executed. In volatile or thinly traded markets, slippage can lead to substantial losses. Our custom-built systems and deep exchange integrations allow us to execute large trades with minimal market impact, ensuring your orders are filled close to your target prices.

24/7 Monitoring & Execution

We don’t sleep so your market doesn’t either. Our team provides around-the-clock execution and market surveillance to ensure uninterrupted liquidity and protection against market anomalies.